Aligning Business Strategy with your Personal Goals

No video selected

Select a video type in the sidebar.

Business Valuation as a tool for Strategy

Understanding value, now and periodically as you implement your strategy, is fundamental to optimising the return from your Business Exit.

Three questions to ponder

Current Value

Do you know the real current value of your business as viewed by investors and acquirers?Strategy Alignment

Is your strategy aligned with optimising your business value?Sellability

Do you know how to improve the odds of being able to sell your business?

Room for improvement?

Most owners we speak with recognise that even successful businesses can do with incorporating an Exit Strategy approach to aligning business development with their personal goals.

We work with you to:

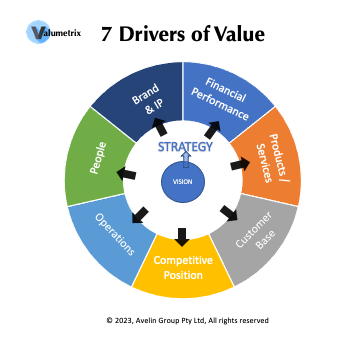

Ensure that there is a clear understanding of what drives business valuation and saleability.

Provide shareholders with clarity around how the current strategy may impact value creation.

Deliver a yardstick that shows progress on the value creation strategy, rather than performance on operational measures.

How well is your business doing on the Value Drivers that matter to buyers and investors?

A Toolkit to create Value

- Set a baseline for the business

- Build a common focus with your key people

- Regularly evaluate progress

- Demonstrate awareness of and pre-empt buyer concerns

Why consider us?

Many people conduct valuations. Not all are familiar with the mindset of prospective investors and acquirers. Our background gives us the insight into what matters in assessing a business, now as well as its future prospects, by doing a full appraisal rather than focusing simply on the valuation. It’s that insight which can help shape a strategy that best prepares you for an exit...

... and we have built and sold businesses. It doesn't always go the way you expect, so we think that experience can help other business owners.

We could go on but, we find that a conversation is a more efficient way of helping you decide just how our skills will help.

How we work with you

Founder Workshop

Key benefits

-

Most importantly we get to see how it might be to work together!

-

Introduction to valuation methods used by investors and acquirers.

-

Review of strategic goals for the business.

-

Discussion on founder’s personal and financial objectives and the timeline to achieve those.

-

Overview of pathways that can optimise value and the likelihood of a successful exit.

Business Appraisal

Key benefits

-

A valuation appraisal suitable for setting strategic objectives and framing a discussion with an investor or acquirer.

-

The process ensures internal inputs through interviews, your assessment of key business elements and normalising historical accounting data.

-

Main deliverable is a report that uses multiple valuation techniques to arrive at a valuation range that recognises how investors or acquirers assess the value of the business. The appraisal metrics ensure that progress on key value drivers can be tracked over time.

Progressive Review

Key benefits

-

Periodic business appraisal provides a clearer picture of the effectiveness of strategy implementation in building value.

-

The report updates the initial valuation to gauge progress on the key strategic value drivers.

-

Maintains focus on ensuring that the business continues to grow towards its valuation target.

Get in touch

No obligation, Let's see if our ideas resonate with you.

Send an email below

or, if you prefer, book a free consultation.